capital gains tax philippines

D Capital Gains from Sale of Real Property. Last reviewed - 30 June 2022.

How To Compute Capital Gains Tax Train Law Youtube

In the Philippines the government refers to inheritance.

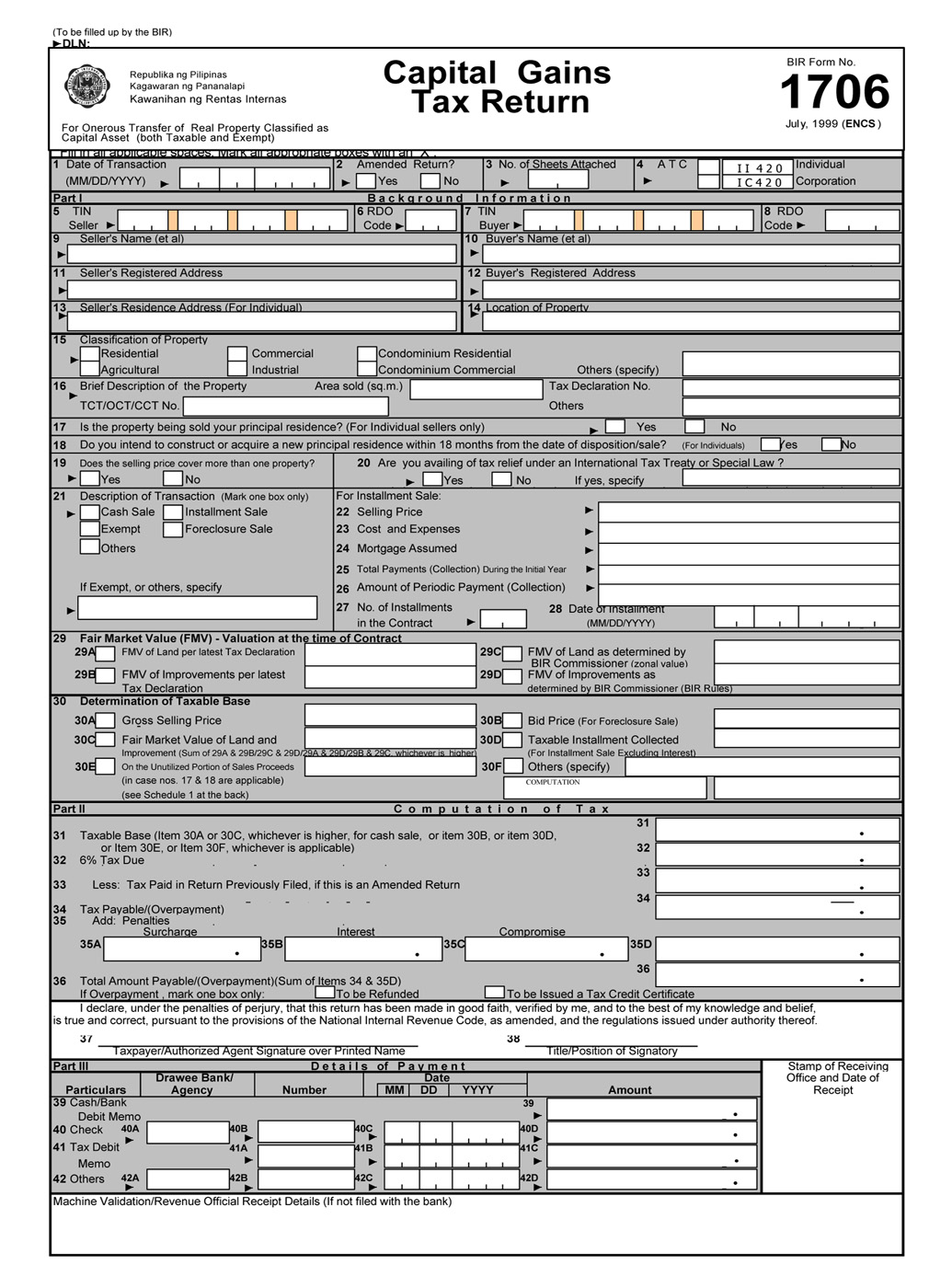

. 1 In General. Capital gains tax on sale of real property located in the Philippines and held as capital asses is based on the presumed gains. In usual transactions the selling broker would help the seller pay the 6 Capital Gains Tax for free while the buying broker is not required to do the Title transfer unless the broker buyer made.

- The provisions of Section 39 B notwithstanding a final tax of six percent 6 based on the gross selling price. In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions. Capital gains presumed to be realized from the sale of a real property not categorized as ordinary asset is subject to a tax of six percent 6 based on the highest.

Capital gains from the sale of real property located in the Philippines classified as capital assets by individuals are subject to a capital gains tax of 6 percent based on gross selling price or the. The property is directly and jointly owned by. Pacto de retro sales and.

Capital gains tax CGT is imposed on both. A capital gains tax may be imposed if and only if the Securities and Exchange. According to the National Bureau of Internal Revenue section 24D the capital gains tax rate is 6 of the propertys selling price.

For late filing of Tax Returns with Tax Due to be paid the following penalties will be imposed upon filing in addition to the tax due. Capital Gains Tax is imposed on gain that the seller gets from a sale exchange or other transfer of capital assets that are located in the Philippines. To calculate the capital gains tax you check.

Id like to ask if. Interest on bank savings time deposits deposit substitutes and money market placements received by domestic or resident foreign corporations from a. 181 thoughts on Capital Gains Tax in the Philippines Rate to use How to Calculate and Pay Rodolfo Convocar.

Inheritance tax is a tax placed on estates or assets that are passed on via a will of a deceased or the law of succession. Capital positive factors tax on sale of actual property positioned within the Philippines and held as capital asses is predicated on the presumed positive factors. The rates are 06 of the gross selling price for shares of.

Capital gains taxes. The rate is 6 capital gains tax based on the higher amount. May 20 2022 at 920 am Good am Atty.

PENALTIES FOR LATE FILING OF TAX RETURNS. The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing. Gains from the sale are considered Philippine-source income and are thus taxable in the Philippines regardless of the place of sale.

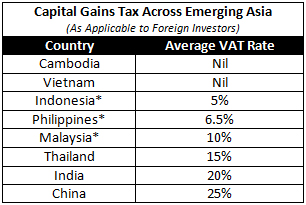

Non-resident aliens are taxed on Philippine-source capital gains irrespective of their period of stay in the Philippines. Philippine Tax Classifications and Cryptocurrency Income Tax. The Philippines is strategically located off the southeastern coast of mainland Asia with a flying time of four hours or less to most major.

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

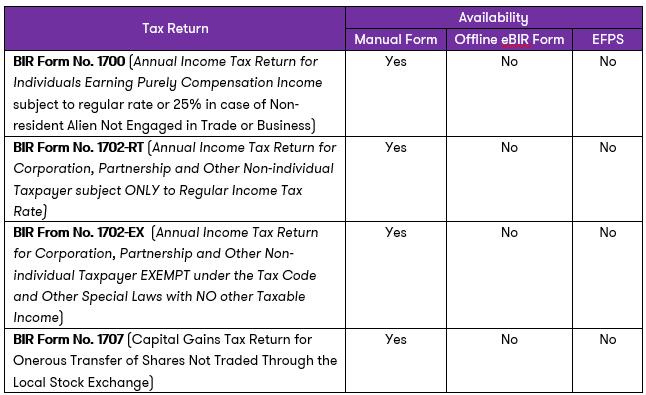

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Income Tax Computation For Corporate Taxpayers Prepared By

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

Capital Gains Tax China Briefing News

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax What Is It When Do You Pay It

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

Duterte S Economic Managers Not Concerned About Below Target Yield From Train Gma News Online

How To Compute Capital Gains Tax On Sale Of Real Property Business Tips Philippines

Bir Form 1706 Fill Online Printable Fillable Blank Pdffiller

How To Compute File And Pay Capital Gains Tax In The Philippines An Ultimate Guide Filipiknow

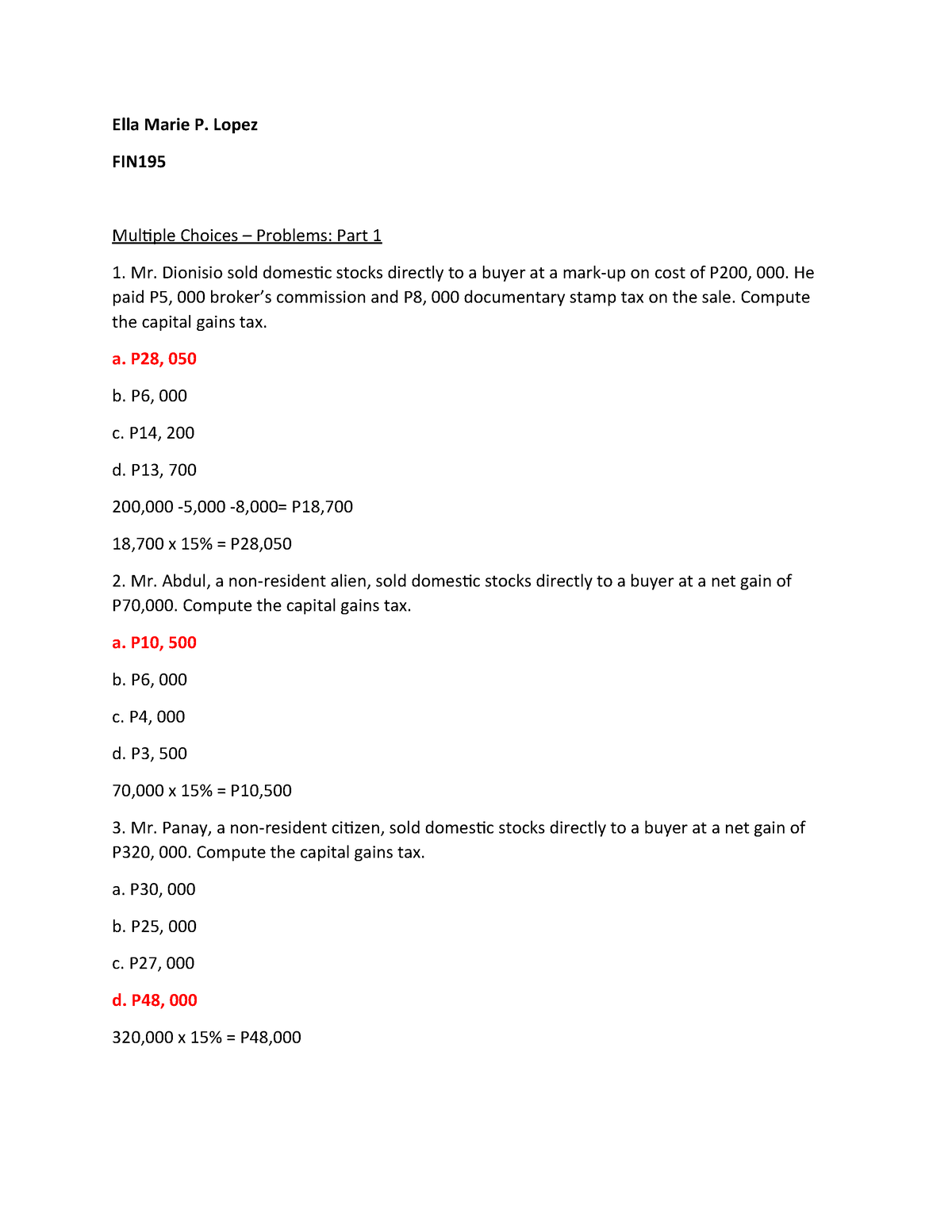

Capital Gains Tax Ella Marie P Lopez Fin Multiple Choices Problems Part 1 Mr Dionisio Sold Studocu

Train Series Part 4 Amendments To Withholding Tax Regulations Zico

How To Compute Capital Gains Tax When And Where To File And Pay Real Estate 101 Philippines Youtube